Your Rates & Notice Explained

How are my rates calculated?

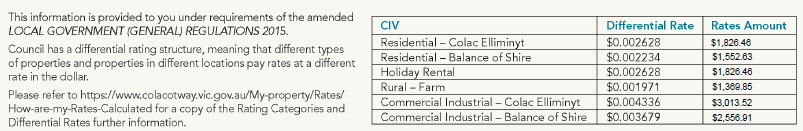

Council bases its rate calculation on the Capital Improved Value (CIV) of each individual property. The rate in the CIV dollar is set by Council as part of its annual budget process and may include differential rates for different types of properties.

Your annual rates notice covers the period from 1 July to 30 June each financial year. Council has a differential rating structure, meaning that different types of properties and properties in different locations pay rates at a different rate in the dollar.

Please refer to Rating Categories and Differential Rates(PDF, 290KB) for further information on the categories and rates in the dollar. An example of Rates calculations for different property categories is on Page 2.

Rates Notice - Example(PDF, 495KB)

Your Rates and Charges Explained

The amount of rates and charges you pay is made up of the parts shown listed below. Please refer to your rates notice for a breakdown of your rates charges for each of these categories.

| Rates/Charges |

How this part is calculated and what it's used for |

| General Rates |

- General rates are calculated by multiplying the 'Capital Improved Valuation' (CIV) of the property by a rate in the dollar.

- General rates are used to pay for the provision of over 100 services to the community.

|

| Municipal Charge |

- This charge is set by Council in its budget and applied to all properties, except eligible single farm enterprises.

- The municipal charge pays for some of Council's administrative costs and is the same amount for all properties. Some single farm enterprises with multiple rates assessments are eligible for an exemption from this charge on some of their assessments.

|

| Fire Services Property Levy (FSPL) - Fixed |

- This is a fixed charge set by the State Government.

- The money collected is used by the State Government to fund provision of fire services throughout Victoria.

|

| Fire Services Property Levy (FSPL) - Variable |

- This is a variable amount calculated by multiplying the Capital Improved Valuation (CIV) of the property by a rate in the dollar set by the State Government.

- The money collected is used by the State Government to fund provision of fire services throughout Victoria.

|

Variable Charges

There are a number of variables that may be applicable to your property depending on your circumstances

| Rates/Charges |

How this part is calculated and what it's used for |

| Arrears |

- Overdue rates and interest from previous year/s less any payments made in the current financial year; or

- Credit amount if rates were overpaid in previous year (will show a minus figure)

|

| Pension Rebates |

- State Government Rebate for eligible Pension card holders

- Fire Service Levy Rebate for eligible Pension Card Holders

|

| Waste Management Charge |

- This charge is set by Council in its budget and is based on apportioning the cost of the kerbside waste collection service to all properties that receive a benefit from the service.

- This charge pays for the cost of having contractors provide the kerbside collection service.

- All developed properties within the declared service areas are levied regardless of whether they use the service or not.

- Properties outside declared areas are not charged.

|

| Single Farm Enterprise Exemption |

- Municipal Charge and Fire Service Levy Fixed is charged on one property within the Single Farm Enterprise in each Council

|

| Tirrengower Drainage |

- Special Charge for maintenance of the Tirrengower Drainage System

- Charge is $2.50 per Hectare

|

| Trust for Nature Rebate |

- This rebate is available for Trust for Nature properties

- Rebate is $10.00 per Trust for Nature Hectare up to $1,000

|

Your Rates Notice Explained

Your Rates Notice has a lot of important information relating to your property, valuation and rates & charges. The requirements for the contents of the Rates Notice are set out in the Local Government (General) Regulations 2015.

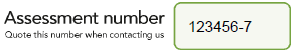

| ASSESSMENT NUMBER |

- Council's identification number for your property (e.g. 123456), including a check digit (e.g. 7) used for error detection to ensure the assessment number is typed correctly

- Assessment number is used as the reference to pay your rates and is unique to each property you own

|

| ISSUE DATE |

- Date the Rates Notice was printed

|

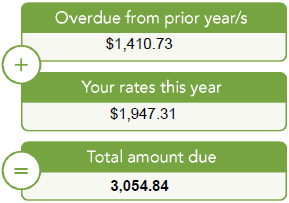

| RATES DUE |

|

| Overdue from prior year/s |

- Overdue rates and interest from previous year/s less any payments made in the current financial year; or

- Credit amount if rates were overpaid in previous year (will show a minus figure)

|

| Your rates this year |

- Total of current financial years rates and charges

|

| Total amount due |

- Total amount due including current and overdue rates

- Less any rebates applicable to the rates

|

| E NOTICE |

- Unique reference number to sign up for emailed Rates Notices (will change on each new Notice issued)

|

| PROPERTY |

|

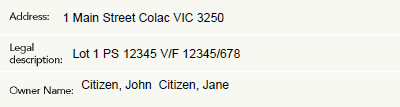

| Address |

- The street address of your property

- Council sets the street addressing of all properties in the municipality

- The street address is used by Emergency and Utility Services to identify your property

- Property owners and occupiers are responsible to clearly display their street number at their property

|

| Legal Description |

- The title details of all lots attached to the assessment, including any government licenes (e.g. grazing license)

|

| Owner Name |

- The legal owner/s of the property

|

| VALUATION |

|

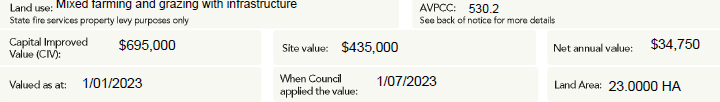

| Land Use |

- The AVPCC land use description

|

| AVPCC |

- An Australian Valuation Property Classification Code (AVPCC) is allocated to each property by the valuer (appointed by Valuer-General Victoria) according to the use of the land – e.g. house, shop, farm

- The land use classification is then used to calculate the Fire Services Property Levy (FSPL)

|

| Capital Improved Value (CIV) |

- The value of vacant land (site value) plus any capital improvements made to the land (e.g. buildings, fencing, etc).

- The rates and charges you pay are based on the (CIV) of the property

|

| Site Value (SV) |

- Value of the land excluding improvements

|

| Net Annual Value (NV) |

- Fixed by Victorian Government legislation to be 5% of the CIV for residential and rural properties

- For commercial or industrial properties it is the estimated annual market rent and cannot be less than 5% of the CIV

|

| Valued As At |

- This is the date that the property was assessed and valued at

|

| When Council applied the Value |

- This is the date that the Valuation has been used to calculate the rates

|

| Land Area |

- Area of all land attached to the assessment

|

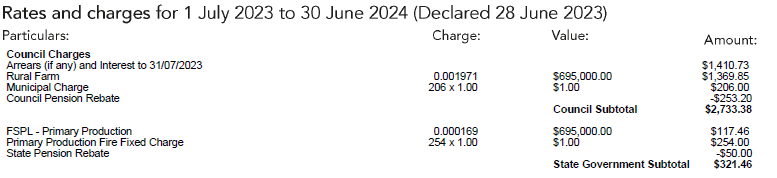

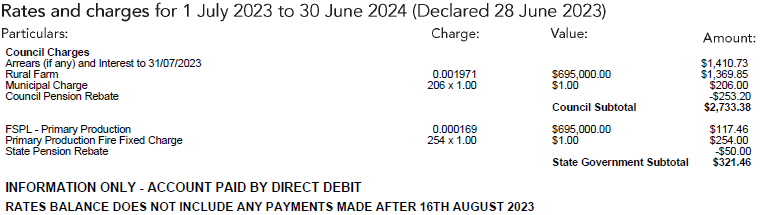

| RATES AND CHARGES |

|

| Rating Year |

- The period relating to this notice, effective from 1 July to 30 June each year

|

| Declared Date |

- Date the budget, including annual rates and charges, was adopted by Council

|

| Rates and Charges |

- Rates and Charges applicable to your property for the current financial year

- Refer to Your Rates and Charges Explained for further information

|

| Notes |

- Date the rates were extracted for printing the Notice, any payments or changes made to your rates after this date are not included, please contact Council if you need an updated balance

- Advice paying rates by Direct Debit if applicable

|

| PAYMENT OPTIONS |

|

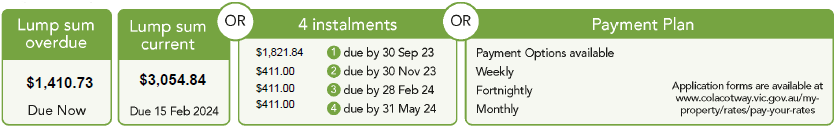

| Lump Sum Overdue |

- This amount is overdue from previous year/s and is due to be paid immediately

- Interest is charged monthly on overdue rates at 10% per annum

- Payment Plans are available if you need assistance

|

| Lump Sum Current |

- Total rates owing including current and overdue amounts

- This is the amount to pay if you wish to pay in full (due 15 February)

|

| Instalments |

- Your rates and charges amount due in instalments by the respective dates

- Payment of the 1st instalment must be received by 30 September

- Late payments are accepted, please email notification of payment to inq@colacotway.vic.gov.au as we will need to manually change you to instalments

- Instalment notices will be issued for the remaining three instalments

|

| Payment Plan |

|

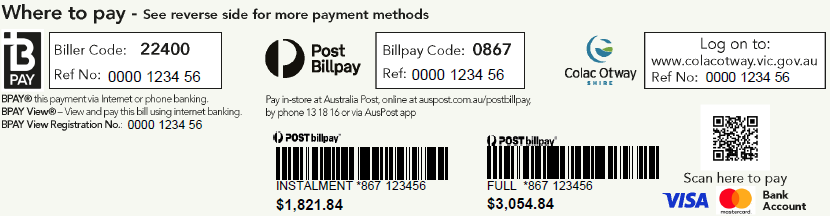

| WHERE TO PAY |

|

| Make a payment |

- Payments can be made via BPay, Australia Post, Councils website, phone or office

- Reference number is unique to each account you have with Council (one for each individual Rates, Animal or Debtor)

- Please ensure you use the correct reference number for your payment as it will automatically be paid to that account

- If you have made a payment to the wrong account (e.g. a previously owned property, your animal registration or debtor account) please email Council at inq@colacotway.vic.gov.au to request the payment be transferred. A copy or screen shot of the payment is required.

|

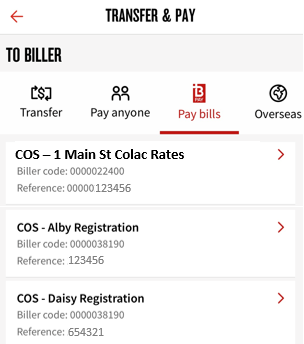

| Handy Tip! |

- Name each Council account to easily identify the property, animal or debtor account you are paying

|

| DIFFERENTIAL RATE |

- The rate in the dollar charged for each rating category

- The general rates amount for each category based on your valuation

- If you believe the rating category on your rates is incorrect, please lodge an objection within two months of receiving your Notice (or email Council at inq@colacotway.vic.gov.au if it is outside the two months)

|

What do my Rates pay for?

Your rates help the Colac Otway Shire deliver a diverse range of community services, as well as ongoing maintenance and development of critical infrastructure. Rates help facilitate so much of what is essential in our everyday lives. All property owners have a responsibility to pay a fair share of rates for the benefit of all community members.

Your rates help to fund more than 100 valued community services and local infrastructure for the whole community to enjoy - from footpaths, street lights, roads and bins to the parks, gardens, sports facilities and community events. Council removes your waste, provide free libraries, family day care, immunise babies and deliver meals to the homes of older people.

Rates Capping

Each year the Minister for Local Government sets a cap on rate increases based on that period’s Consumer Price Index (CPI) and advice from the Essential Services Commission (ESC).

The rate cap does not apply to individual rates notices. The overall rate revenue collected by a council cannot exceed the current rate cap, but how much each property owner pays is determined by the value of your property.

Further information on Rates Capping can be found here